If you can't beat them, join them says the old proverb. The South African MNO Cell C has taken this seriously. A news article back in September said:

In a bid to give its customers access to world-class network quality, excellent service and innovative value offers, Cell C has over the last eight months deactivated 39% of its physical radio access network (RAN) towers with 100% migration in the Eastern Cape, Free State, Northern Cape and Limpopo.

Over the next four months, Cell C plans to decommission a further 5% of its towers, with a focus on parts of Kwa-Zulu Natal and Mpumalanga.

Rather than spending billions building network infrastructure to compete with its fellow mobile giants, the company concluded roaming agreements with network partners like MTN and Vodacom to use the spare capacity that they have on their networks.

Prepaid customers will roam on the MTN network, whilst post-paid customers will be on the Vodacom network.

We see a dual approach by Cell C here. Rather than putting all their eggs in a single basket, they have spread their risk portfolio.

In our blog post last year, we saw that both MTN and Vodacom has similar coverage and capabilities. This would mean that Cell C subscribers will win regardless of whichever network they are on.

With Vodacom, it looks like Cell C is using a roaming agreement and will act like a Thick MVNO. We have explained the different types of MVNOs here but if you prefer to watch a video then see here.

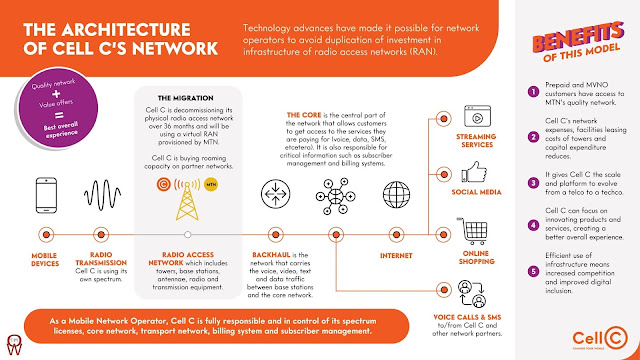

The approach with MTN, based on the above slide shared by them seems to be a combination of MVNO and MORAN. To understand what MORAN is, read here or watch the video here. Cell C explained it as follows back in June:

Cell C has successfully decommissioned 34 percent of its physical Radio Access Network (RAN) sites, while seamlessly migrating prepaid and Mobile Virtual Network Operator (MVNO) customers to roam solely on its partner network, MTN, via a virtual RAN.

The initial Cell C and MTN roaming agreement from 2018 provided coverage in areas outside of the main metros. The decommissioning of sites in these provinces means that where Cell C customers previously moved between Cell C and MTN towers, they will now only roam on MTN’s network through the virtual radio network provisioned for Cell C, which has wide network coverage.

Based on technology advances it is possible for network operators to avoid duplication of investment in RAN infrastructure. In this model, Cell C will decommission its physical RAN, which includes towers, base stations, antennae, radio and transmission equipment, while MTN will provision a virtual RAN. Cell C will use its own spectrum on this virtual RAN and manage the customer experience. As a mobile network operator Cell C is still responsible for its spectrum licenses, core network, transport network, billing system and subscriber management.

While Cell C continues to refer to the arrangement as 'virtual RAN', it shouldn't be confused with vRAN / Open RAN. It would be interesting to see how this arrangement works and if this will continue for 5G going forward.

Cell C's FY 2020 annual results presentation slides and video may be worth a watch.

Related Posts:

- Operator Watch Blog: High Data Prices in South Africa means Great 4G coverage but Poor Subscription Rates

- The 3G4G Blog: MNO, MVNO, MVNA, MVNE - The different types of operators

- Telecoms Infrastructure Blog: Passive and Active Infrastructure Sharing

- The 3G4G Blog: Quick tutorial on Mobile Network Sharing Options