Dr. Kim Larsen, CTIO of T-Mobile Netherlands is very well known as a speaker and on social networks for his honest analysis and insights. We have also used information from him for blog posts for over a decade.

In a recent post on LinkedIn, he nicely summarized the mobile spectrum stars of Europe. In his words:

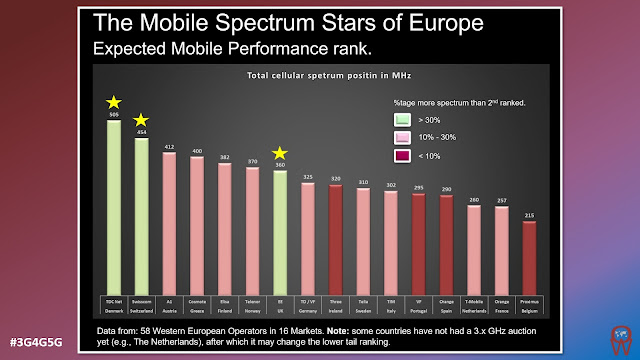

Based on the analysis of 58 Western European MNOs and their spectrum position, the highest expected mobile performance across markets and operators can be shown. Of course, it does require the MNOs to actively use their acquired cellular spectrum and deploy a market- & spectrum-appropriate antenna technology, such as described in my previous blog "RAN Unleased"

How to have the best mobile RAN. An excellent article by the CTIO of @TMobile_NL @KimKLarsen on how to build it. The trade-offs between sites, spectrum and antenna's. In NL very important, bc 8Mbps real world performance is obligation now and in future https://t.co/FlekocddOI

— Rudolf van der Berg (@internetthought) January 26, 2022

The MNO rank within a country will depend on the relative spectrum position between 1st and 2nd operator. If below 10% (i.e., dark red in chart below), I assess that it will be relative easy for number 2 to match or beat number 1 with improved antenna technology. As the relative strength of the spectrum position of number 1 relative to number 2 is increased, it will become increasingly difficult (assuming number 1 uses an optimal deployment strategy).

The Stars (e.g., #TDCNet / #Nuuday, #Swisscom and #EE) have more than a 30% relative spectrum strength compared to the 2nd ranked MNO in a given market. They will have to severely mess up, not to take (or have!) the best cellular network position in their relevant markets. Moreover, network economically, the Stars should have a substantial better Capex position compared to their competitors (although 1 of the Stars seem a "bit" out-of-whack in their sustainable Capex spend, but may be due to fixed broadband focus as well?). As a "cherry on the pie" both Nuuday/TDCNet and Swisscom have some of the strongest spectral overhead positions (i.e., MHz per pop) in Western Europe, which is obviously should enable superior customer experience.

While this is definitely a good metric to compare, as an analyst and a marketeer, I also think there is also a big role for how operators advertise their services and differentiators to reach the end customers. It may not be too difficult for a second operator (in terms of spectrum holding) to beat the first one with right marketing.

Happy to hear what you have to say.

Related Posts:

- The 3G4G Blog: What will 5G Standalone deliver?

- Operator Watch Blog: 8.05 Billion Mobile Subscribers with 5.22 Billion Unique by End of 2020

- Operator Watch Blog: World's Largest Mobile Networks by Data Traffic - March 2021

- Operator Watch Blog: How many 5G Cell Towers & Base Stations Worldwide?

No comments:

Post a Comment