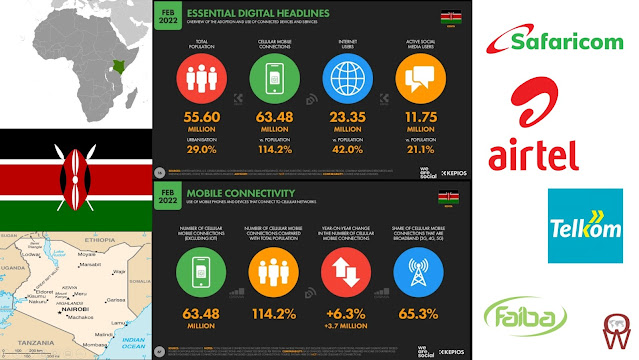

Kenya’s telecom market continues to undergo considerable changes in the wake of increased competition, improved international connectivity, and rapid developments in the mobile market. The country is directly connected to a number of submarine cables, and with Mombasa as a landing point for LIT’s newly completed East and West Africa terrestrial network, the country serves as a key junction for onward connectivity to the Arabian states and the Far East. The additional internet capacity has meant that the cost of internet access has fallen dramatically in recent years, allowing services to be affordable to a far greater proportion of the population. In parallel, the sector’s regulator has reduced interconnection tariffs and implemented a range of measures aimed at developing further competition.

Numerous competitors are rolling out national and metropolitan backbone networks and wireless access networks to deliver services to population centres across the country. Several fibre infrastructure sharing agreements have been forged, and as a result the number of fibre broadband connections has increased sharply in recent years.

Much of the progress in the broadband segment is due to the government’s revised national broadband strategy, which has been updated with goals through to 2030, and which are largely dependent on mobile broadband platforms based on LTE and 5G.

Kenya has currently has four network operators: Safaricom, Airtel, Telkom and Faiba 4G.

2G is on 900 and 1800 MHz and 3G on 2100 MHz on all three providers. 4G/LTE has started in 2014 with Safaricom on 800 (B20) and 1800 MHz (B3) and has started with Airtel on 800 MHz (B20).In 2017 Faiba launched its 4G-only network in a very limited area of the country.

Coverage is pretty good, except for the very remote areas in the north, but mobile towers are sometimes overload, which leads to slow speeds. But the mobile network is rapidly being expanded.

Safaricom has been ranked as having the best network in Kenya – for data and calls – after independent network tests from global company Umlaut.

Umlaut's mobile benchmarking unit analyzed the mobile networks of Kenya to rank their performance. It measured smartphone voice and data performance based on extensive "drive tests" – from major metropolitan areas to smaller cities and connection roads, which it did between September 24, 2020, and October 26, 2020.

Umlaut found Safaricom to be the only mobile operator to deploy voice-over-LTE (VoLTE) services across the country including in rural areas, therefore contributing to the operator achieving the best call set-up time. In the tests, Safaricom achieved average download speeds up to 58.5 Mbit/s and average upload speeds up to 36.4 Mbit/s.

Safaricom said in a statement that its top performance in mobile data was due to its deployment of 4G carrier aggregation, which made it the only operator to exceed 20MHz in data upload tests.

"4G Carrier Aggregation enables Safaricom to combine its 4G bandwidth on both the 1800 and 800 frequency bands. In turn, this means Safaricom's 4G customers can establish more than one simultaneous connection to network masts thus achieving more than 150% the speeds of a typical 4G connection,"

The mobile operator has been aggressively expanding its 4G coverage with a goal of having 100% of its network on 4G. Safaricom is also by far the biggest operator in Kenya with over 35.6 million customers and about 65% market share at the end of 2020, according to statistics from market research company Omdia.

Kenya becomes the second African country to launch 5G — Quartz Africa https://t.co/kBTClfWyXX

— Amb. Macharia Kamau (@AmbMKamau) April 2, 2021

Safaricom announced the launch of 5G trials in March 2021 for both individual and enterprise customers in Nairobi, Kisumu, Kisii and Kakamega. As part of the trials, the operator plans to expand the number of 5G sites to more than 150 across nine towns over the next twelve months. The primary objective during the trial period will be to establish if customers can access speeds of up to 700Mbps, with plans to offer speeds of up to 1Gbps in coming months. Nokia and Huawei have been chosen as the two technology partners to implement the rollout of Safaricom’s 5G network.

Safaricom has also signed a multi-year contract with satellite provider Intelsat to modernise its network and expand LTE coverage. Under the deal, Intelsat will provide cellular backhaul and satellite and enterprise connectivity services.

Airtel, owned by Indian Bharti Airtel is the second provider in the country. In 2017 Airtel is set to begin trialling a 4G/LTE network in the capital Nairobi and will be expanded to 45 other sites in major towns, including Mombasa and Kisumu within the year. In 2018 it bought their license on band 20 (800 MHz) and in May Airtel announced the commercial launch of 4G/LTE services.

Airtel Kenya has recently received a ten-year frequency licence comprising 2×10MHz of spectrum in the 2100MHz band. Airtel agreed to pay USD10 million for the licence, which will be valid until 2032. In respect of settlements regarding its 2015-2025 operating and spectrum licence, Airtel will pay a total of USD20 million in four instalments over the next three years.

Established as a telecommunications operator in April 1999, Telkom is 60 per cent owned by Helios Investment Partners, with the remaining stake held by Kenyans through the Government of Kenya. Telkom has 4,152 km of its own terrestrial fibre cabling, serving as a key conduit for broadband connectivity, inland. Telkom Kenya also owns a 22.5% stake in TEAMS, a 5,000km undersea fibre optic cable through Fujairah, UAE, and a 10% stake in LION2, another 2,700km undersea fibre optic cable through Mauritius. It also owns a stake in the East African Submarine System Cable (EASSy) and manages the National Optic Fibre Backbone Infrastructure (NOFBI), on behalf of the Ministry of ICT, an inland fibre optic cable network running through Kenyan counties.

Telkom Kenya has signed a Memorandum of Understanding (MoU) with Ericsson and systems integrator NEC XON to deploy an additional 2,000 4G LTE base stations across the country by 2023. In a press release, Telkom Kenya confirmed the USD100 million modernisation project will deliver a four-fold increase in its 4G mobile footprint, reaching ‘the majority of citizens across Kenya’. In so doing, the company hopes to deliver improved service availability as it looks to bridge the digital divide and provide Kenyans with an enhanced customer experience. The nationwide rollout is part of Telkom’s long-term network expansion strategy, announced in August 2020, when it underwent a strategic reorganisation.

Faiba 4G by triple-play provider Jamii Telecommunications Ltd. (JTL) started in December 2017 in a very limited area a 4G-only network on 700 MHz (Band 28). There is no fallback to 2G or 3G and all voice services are provided through VoLTE.

At launch, Faiba boasts of 300 base stations with a target of achieving 1000 stations by 2020. JTL says that Faiba customers can achieve up to 72 Mbps speeds. Faiba is so far available in the following areas: Nairobi, Mombasa, Nakuru, Eldoret, Kisumu and Thika.

Related Posts:

- Operator Watch Blog: Kenya has a Model Mobile Market

.jpg)