Philippine’s telecom sector in 2020 suffered only minor impact as a result of the Covid-19 pandemic. Subscriber numbers fell in some areas, but this was offset by strong growth in mobile data and broadband usage since a significant proportion of the population transitioned to working or studying from home. Major investment programs covering LTE, 5G, and fibre broadband networks suffered slight delays due to holdups in supply chains, but activity has since ramped up in an attempt to complete the rollouts as per the original schedule.

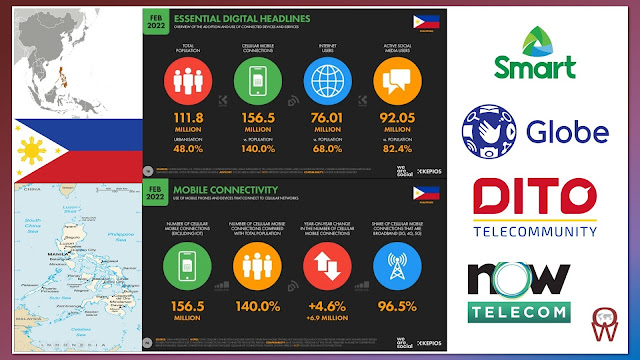

Currently there are four mobile operators in the country. The major telecom operators had mixed financial results during the Pandemic. PLDT reported record revenues, whereas Globe Telecom’s performance dropped below 2019 levels. Shifts in customer behaviour during the enforced lockdown bolstered mobile data and broadband, whereas Globe Telecom’s leadership of the mobile market saw it suffer to a greater extent overall, as the total number of mobile subscribers fell in the first quarter of 2021. In spite of the setback, both companies predicted a positive outlook for growth through the rest of 2021 and into 2022.

PLDT and Globe Telecom have maintained their dominance of the Philippines telecom market, despite having their duopoly status removed by the government as far back as 2017. Two new entrants – DITO Telecommunity and NOW Telecom – have since become the third and fourth operators, but delays in their respective launch programs have caused minimal impact to the leaders’ market share. The government remains keen, and committed, to seeing strong competition, growth, and service excellence in the telecom sector, so there is likely to be continued support (financially as well as through legislation such as enabling mobile tower sharing and number portability) to ensure that the sector remains viable for emerging players.

The mobile sector will remain the Philippines’ primary market for telecommunications well into the future. The unique terrain and resulting challenges associated with accessing remote parts of the archipelago means that in many areas fixed networks are neither cost-effective nor logistically viable. Both PLDT and Globe Telecom continue to roll out fixed networks in some urban areas where it remains feasible to do so (primarily to support fixed broadband or — in Globe Telecom’s case — fixed wireless services). However, the bulk of telecoms investment over the coming years will continue to be in 5G and 5G-enabled LTE networks. Coverage of LTE and 5G networks extends to over 95% of the population, and for the vast majority of people mobile will likely remain their only platform for telecom services.

In their most recent report on The Philippines, Open Signal have directly compared for the first time, the mobile network experience and the 5G experience of Filipino users in the same report and in another first they have also analyzed the consistency of users’ experience. Smart is once again the operator to beat in the Philippines. This time around it has snapped up 11 out of a possible 16 awards including all those for download speed and users’ experience when playing multiplayer mobile games or using over-the-top voice apps on cellular connections. DITO comes top for both Upload Speed Experience and Availability, while Globe wins the 5G Video Experience award and both awards for consistent quality.

Smart Communications by PLDT Inc, on of the two leading providers in the Philippines, as of end June 2021, had a total of 71.68 million mobile subscribers.

Smart announced they were teaming up with South Korea’s Samsung Electronics to accelerate the deployment of 5G Standalone (5G SA) technology in the Philippines. The pair recently activated commercial 5G SA sites in Makati City in the wake of Samsung’s successful Voice-over-New Radio (VoNR) tests at the PLDT-Smart Technolab in the city.

To support growing mobile data traffic, Smart has deployed base stations nationwide as of end-December 2021, supporting its 4G/LTE and 5G subscribers from Batanes to Tawi-Tawi. This includes around 16,900 3G base stations, 38,600 4G/LTE base stations and 7,200 5G base stations.

Smart is the outright winner of all four Open Signal awards for users’ experience when playing multiplayer mobile games and using voice applications over cellular connections. Smart’s margin of victory is impressive for both Games Experience and 5G Games Experience for the former, its score of 54 points is 12.9 points (31.5%) higher than that of second placed DITO. Smart wins 5G Games Experience with a score of 68.1 points, ahead of Globe’s score of 56.8 points by an impressive 11.3 points.

Globe Telecom, the other major telecommunications provider in the Philippines, had the majority of its customer base in its mobile segment. In 2021, the company had around 87 million mobile subscribers, including postpaid and prepaid. In addition, Globe Telecom had around 3.7 million home broadband subscribers and 1.3 million landline subscribers.

It has now been over a year since DITO entered the market as the Philippines’ third mobile operator and it announced in March 2022 that its customer base had grown to seven million active mobile subscribers and that it was close to hitting its year three commitment to provide 70% population coverage, having deployed more than 4,000 cell towers.

DITO has recently launched a 5G home broadband service in some areas of the National Capital Region (NCR), it has yet to commercially launch a 5G mobile service.

Our recent insight for the Philippines shows that Filipino smartphone users on average had a worse experience before they changed operators, spending more time without signal and less time connected to 4G or 5G. Check it out! https://t.co/n3H8UBr1MY#5G #Churn #MobileOperator pic.twitter.com/6TuNoWFPO0

— Opensignal (@opensignal) April 8, 2022

The Philippines now also has a fourth major commercial mobile operator, with Now Telecom set to launch 5G services and build out a backbone network across the country.

With an enterprise offering that includes wireless broadband and cloud services, Now Telecom is well positioned to enter the consumer market in the Philippines as it holds both a congressional franchise for telecom services valid for the next 25 years as well as a mobile telecoms licence.

With the new provisional license Now Telecom can use 220MHz of spectrum in the 1,970MHz-1,980MHz, alongside 2160Mhz to 2170Mhz and 3.6Ghz to 3.8Ghz, including 5G frequencies for mobile and fixed wireless.

Related Posts:

- Operator Watch Blog: Philippines Dynamic Mobile Market has been Tipped for Improvement

No comments:

Post a Comment