Cambodia’s mobile-dominated telecoms sector spent the last couple of years battling two major challenges: the global pandemic, and the government’s retraction of trial licenses for the rollout of 5G.

Citing concerns about wastage and inefficiency occurring if each operator built a separate 5G infrastructure in order to maximise their own network’s coverage (and, presumably, to capture greater market share), the regulator withdrew the licenses that the operators had been using for their 5G trials. This was despite all of the operators having already announced a successful completion of their trials. More than a year later, the market is still waiting on the government to release its 5G policy and roadmap, along with the allocation of spectrum and approvals to permit commercial operation.

In the meantime, the mobile network operators have maintained their focus and investment strategies on upgrading and expanding their existing LTE networks around the country, and to 5G-enable their base stations. When the 5G market eventually arrives, the underlying infrastructure will at least be ready to support a rapid adoption of the higher-value applications and services.

Overall, the mobile market fell back slightly during 2020 and 2021 (in terms of total subscriber numbers) as the Covid-19 crisis wore on, but it remains in relatively good health as mobile users increased their data usage over the period. Likewise, the mobile broadband market experienced a small but very rare contraction in 2020, although penetration rates were already very high in this area. There is likely to be a quick rebound to previous levels once economic conditions stabilise, followed by a modest rates of growth over the next five years.

Are those solar panels? The entire cell tower runs off solar??? Cool!!

— Corey McKay (@CMcKayFL) October 9, 2020

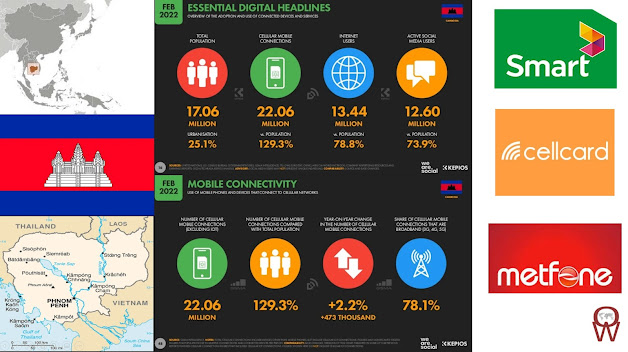

The number of providers in Cambodia has decreased from 9 to 3 in recent years, currently there the main operators are Metfone (by Viettel), Smart (by Axiata) and Cellcard (by Mobitel).

2G/GSM is on 900 and 1800 MHz, 3G on 2100 MHz and 4G/LTE has started on Metfone, Smart and Cellcard so far on 1800 MHz (band 3).

According to the most recent Open Signal report on Cambodia 5G remains some way off, with a representative of the Ministry of Post and Telecommunications saying that both the release of the 5G roadmap and the assignment of 5G spectrum to operators will hopefully occur in 2022. In addition, Cambodia’s mobile networks are struggling under the weight of the nation’s high data consumption. In the Quantifying the Impact of 5G and COVID-19 on Mobile Data Consumption report, it was found that Cambodian users consumed a staggering 15.9 GB of data per month on average in Q1 2021, up from the 13.6 GB/month observed in Q1 2020.

New report on Cambodia! Find out how the 3 national #telecom carriers compare across our 10 measures of Mobile Network Experience, including #mobilegaming, video streaming, #4G availability & more 👉 https://t.co/2BAmDeVQix pic.twitter.com/M13nzyCAGP

— Opensignal (@opensignal) August 3, 2022

Back in June, Smart Axiata’s CEO Thomas Hundt said that high data consumption had “loaded the 4G network to a level where the operators can’t fully satisfy the expectations from the users in terms of speed anymore”, but he also indicated that this congestion would ease once 5G is deployed.

The market leader Metfone currently has registered up to 9 million subscribers, occupying 50% of the market share.

Metfone, has recently signed a credit package contract with MB Cambodia for the upgrade and expansion of its telecoms network, reports Khmer Times. Under the agreement, MB Cambodia, a branch of Vietnam’s Military Commercial Joint Stock Bank, will provide a credit package with a limit of up to USD100 million.

Metfone has developed the School Information System (SIS) to promote online learning to ensure students were not deprived of education during the health crisis. The SIS platform is equipped with a range of useful features, with documents able to be stored and retrieved quickly, and its digital archiving system enables school information to be stored securely and safely, unlike in physical form where documents can get damaged. Metfone plans to make the system available for all schools across the Kingdom.

Smart, a.k.a. Hello Axiata and Smart Mobile, is the 2nd provider in Cambodia. They were the first network to have started with 4G/LTE in 2014.

Smart Axiata has invested more than $90 million in its wireless network in 2021. The operator aims to expand and improve its network to ensure stable and fast mobile broadband connectivity for its eight million subscribers. The main focus of the upgrade will be on enhancing the 4G LTE network. However, Smart also intends to ensure the network is ready for a major 5G upgrade once the government gives 5G the go-ahead. In fact so strong has been the adoption of 4G by Smart’s subscribers, that it has plans to shut down its 3G network over the course of 2021 and repurpose the residual frequency spectrum used for 3G to 4G. Smart currently operates approximately 3,000 network sites across Cambodia, allowing its subscribers to use a 4G LTE network that covers 91.5 percent of the population. By the end of 2021, Smart Axiata had planned to add 350 sites to meet the growing demand for robust and dependable connectivity. Existing network sites will receive substantial capacity upgrades.

Smart Axiata has conducted a live 5G trial in the capital Phnom Penh using a mobile device from Chinese equipment vendor Huawei. The firm said that when commercial rollout begins in the next few years, 5G coverage will initially be centred on ‘hotspots’ in major cities. According to Smart Axiata’s CEO Thomas Hundt:

‘Our mission is to enrich the lives of millions of Cambodians through world-class networks and exceptional digital experiences, which is why we invest USD70 million to USD80 million yearly, primarily in network infrastructure, to improve mobile broadband connectivity across the Kingdom. Trust that we will continue to improve our existing 4.5G service while preparing for future technologies like 5G in parallel.’

Cellcard (a.k.a. Mobitel) is the 3rd provider in Cambodia. In 2015 they started with 4G/LTE in Phnom Penh, Siem Reap and 5 other towns on 1800 MHz (band 3). They currently have approximately 3 million subscribers.

During the Pandemic they ramped up efforts to keep communities connected during lockdown by installing more than 169 new 4G LTE sites. The Proudly Khmer and only 100% locally owned mobile communications company. In addition to the new sites, Cellcard engineers installed small cell solutions for indoor coverage at hospitals and community venues and invested in three new mobile Cell on Wheels solutions to add coverage and capacity to outdoor locations to support the Ministry of Health’s response to the pandemic at key treatment sites and test & vaccination centers.

The work is part of Cellcard’s continued long term investment in network expansion which will see a total of 500 4G LTE sites added in Phnom Penh.

Related posts:

- Operator Watch Blog: Cambodia Getting Ready for 5G

.png)

Zaffareen Well done and useful update. But the operators are misleading you. The problem is not enough antennas & spectrum, not 4G vs. 5G. 4G Massive MIMO on 100 MHz of 4G spectrum would do almost as well as 5G. TMO CTO says in theory 5G could deliver 19-52% but in practice the improvement on 4G is minimal, sometime reducing speeds in lower bands. Am I missing something?

ReplyDelete