Tanzania’s telecom sector enjoys effective competition, particularly in the mobile segment. There remains considerable movement within the market, with Smart having stopped services in late 2019 and Tigo Tanzania having completed its merger with Zantel. Millicom in April 2022 completed the sale of its Tigo Tanzania unit to Axian Group, as it sought to focus on its operations in Latin America.

The government has encouraged foreign participation to promote economic growth and social development, and policy reforms have led to the country having one of the most liberal telecom sectors in Africa. The government has also sought to increase broadband penetration by a range of measures, including the reduction in VAT charged on the sale of smartphones and other devices, and reductions in the cost of data. Public opposition to a controversial tax on m-money transactions forced the government in late 2021 to reduce charges by 30%.

The MNOs became the leading ISPs following the launch of mobile broadband services based on 3G and LTE technologies. Operators are hoping for revenue growth in the mobile data services market, given that the voice market is almost entirely prepaid, and voice ARPU continues to fall. To this end, the MNOs have invested in network upgrades, which in turn has supported mobile data use, as well as m-money transfer services and m-banking services. Together, these have become a fast-developing source of revenue.

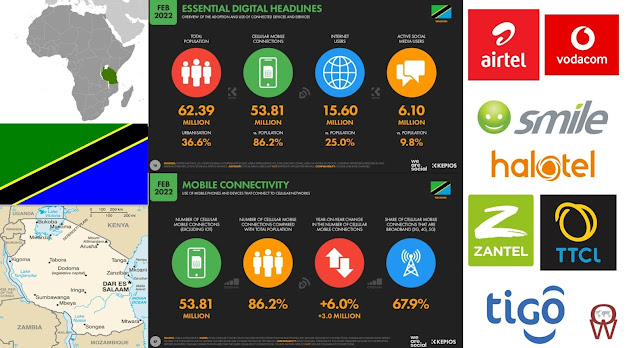

Currently, 5 networks (plus further 3 on LTE) are operating in Tanzania: Vodacom, Tigo, Airtel, Halotel (by Viettel), Zantel (mainly in Zanzibar; merging with Tigo).

In summer 2015 Zantel was aquired from Etisalat by the parent company of Tigo. So it can be expected that their networks may be merged. A 5th license was given out to Vietnam-backed Viettel which started in October 2015 under the brand name of Halotel.

Coverage is generally less than in neighbouring Kenya or Uganda. 2G/GSM is on 900 and 1800 MHz and 3G in some larger villages and towns on 2100 MHz on all providers plus 900 MHz on Airtel. While operators have so far been able to deploy mobile networks to up to 97% of the population, only around 1/3 of them of are able to access 3G networks in the country, so that only 5% are using 3G/4G connections in 2016. In 2017 the regulator TCRA fined all 5 operators for their poor quality of services.

4G/LTE has been started so far only with Tigo in Dar es Salaam on 800 MHz, with Vodacom on 1800 MHz and Zantel in Zanzibar (only Stone Town) on 1800 MHz. Airtel and Halotel are launching 4G/LTE soon.

In 2018 new spectrum on 700 MHz (Band 28) was auctioned and won by Vodacom and still unknown Azam Telecom owned by a Tanzanian businessman for 4G roll-out. From 2012 new operators have started to roll out 4G/LTE only: Smile and TTCL. These operators mostly center on the capital only and don't have any 2G or 3G coverage.

Vodacom, jointly owned by Vodafone and South African Telekom, is the market leader in Tanzania with almost 16 million mobile subscribers at the end of 2021 and a 29.4% market share.

It has the widest coverage in the country for the highest rates. In 2016 4G/LTE was started in Dar es Salaam on 1800 MHz (Band 3), now spread to a few more places. In 2018 it won spectrum on 700 MHz (B28) for 4G with the obligation to cover 60% by 2021 and 90% by 2024.

Vodacom has launched its 5G mobile network service, offering initial speeds of up to 400Mbps and low latency with a wide variety of potential use cases. The company plans to deploy 5G at 230 sites in Dar es Salaam, Zanzibar, Arusha, Dodoma, Mwanza, Iringa, Kagera, Njombe and Mbeya, amongst others. The 5G network is available to fixed enterprise and home internet customers through 5G routers, while mobile phone users will require a 5G-capable handset or device. In the coming months, maximum speeds of up to 800Mbps will be unlocked, with this set to reach 1Gbps ‘once the 5G spectrum is made fully available’. Vodacom’s new network is powered by Finnish equipment vendor Nokia which supplied its 5G AirScale portfolio, Subscriber Data Management software and 5G Gateways.

Vodacom has also announced plans for a US$10 million infrastructure investment to help enhance connectivity in rural Tanzania. The operator said it had signed a contract with the National ICT Broadband Backbone (NICTBB) worth US$4.59 million. That will allow Vodacom to use the government-owned fiber-optic cable infrastructure to better serve customers in rural areas.

This investment comes after an initial investment of US$6.2 million in October 2021 and is set to further spread high-speed Internet facilities upcountry to reach more underserved areas of the East African nation.

Tigo was the first to start 4G/LTE on 800 MHz (B 20) in Dar es Salaam and is available for prepaid (coverage map) in Dar es Salaam, Morogoro, Dodoma, Tanga, Arusha with plans to extend connectivity to Mwanza, Zanzibar (Stone Town) and Kilimanjaro (Moshi).

With a total of 13 million subscribers as of December 2020, Tigo held a 25 percent subscription share in a market.

Axian Telecom and local businessman Rostam Azizi closed the acquisition of Millicom International Cellular’s operations in Tanzania (Tigo) and Zanzibar (Zantel). The consortium says its growth plan includes significant investment in Tanzania over the next five years to strengthen the network coverage and quality of service of the merged entity.

Zantel used to be the local provider on the island of Zanzibar. That's why it has a good coverage there, but had almost no coverage on the mainland. The merger of Zantel with Tigo earned the latter another one million subscribers.

According to TeleGeography’s GlobalComms Database, Airtel is the country’s second largest mobile operator with 14.70 million subscriptions at the end of 2021, representing a market share of 27.2%.

Airtel Tanzania has so far upgraded over 80% of its mobile sites to LTE-A technology, after launching the new high speed ‘Supa 4G’ network in February last year, reports IPP Media. The network, which utilises spectrum in the 700MHz and 2100MHz bands, support speeds of more than 40Mbps and is being rolled out nationwide. ‘We have also significantly increased our coverage by increasing the number of sites in rural areas as our commitment to provide affordable mobile services to all Tanzanians,’ commented the firm’s Managing Director Dinesh Balsingh.

By improving the quality of its 4G services, Airtel Tanzania aims to build customer loyalty and attract new clients, therefore increasing its market share and outrunning Vodacom, the current leader of the Tanzanian market.

Viettel Tanzania, which operates under the brand name Halotel, is aiming to reach the milestone of ten million mobile subscriptions by the end of 2023. In order to attract the additional three million new subscriptions over the next two years, the Vietnamese-owned cellco’s Director of Business Abdallah Salum said it will invest in upgrading network infrastructure, improving service quality and expanding network coverage, particularly increasing the availability of 4G services in more rural areas. At present, the firm’s combined mobile network coverage reaches 95% of the population. In addition, Halotel says it aims to increase the number of its ‘Halopesa’ mobile money subscriptions to five million by the end of 2023.

According to Ookla Halotel offered by far the fastest median download speed in Q1 of 2022 at 17.84 Megabytes per second (Mbps) followed by Vodacom (12.09 Mbps), Airtel (10.6 Mbps), TTCL (10.4 Mbps).

Tigo Tanzania and its sister company Zantel were revealed to have a median download speed of 5.99 Mbps and 4.31 Mbps respectively.

Halotel’s business director Abdallah Salum has attributed the telco’s internet speed to the investment and thought-out strategies. “We have for the past three years directed focus and strategies into expanding internet services coverage in Tanzania,” he said. Mr Salum said with nearly 30 percent of the customers using 4G the company plans to increase the numbers to at least 60 percent by the end of the year.

TTCL for Tanzania Telecommunications Company Ltd. is the state-owned monopoly landline provider in the country. TTCL launched its 4G/LTE mobile data network in 2015 with a five-year rollout plan to cover all regions and main roads in the country called T-Connect. It started in Dar es Salaam on 1800 MHz FD-LTE (band 3) and 2300 MHz TD-LTE (band 40)

In 2016 they announced to deploy 4G/LTE services countrywide by 2018, as the operator intends to accelerate coverage. A number of regions that will benefit from the initiative in phase one: Arusha, Iringa, Mbeya, Dodoma, Morogoro, Mtwara, Mwanza, Tanga, Kilimanjaro and Unguja.

Smile by Smile Communication Tanzania Ltd (Smile TZ) began commercial operations in 2013. The company is a subsidiary a South African telecommunications conglomerate, who has networks in Nigeria, South Africa and Uganda too. Smile Tanzania was the first operator to launch commercial 4G/ LTE services in Tanzania using the 800 MHz frequency (band 20).

Smile recently expanded its 4G LTE mobile broadband services to Zanzibar last month, with customers on the island now able to access maximum speeds of 50Mbps. ‘Following Smile Tanzania’s recent investment in network expansion, we are excited to bring the best 4G LTE broadband internet services to customers in Zanzibar,’ said Smile’s Country Manager Zuweina Farah, adding: ‘The investments have laid a foundation for a more digitally enabled economy, in line with the government’s digital transformation strategy.’ By the end of 2021 Smile’s network reached seven regions of Tanzania but the start of 2022 has seen services enhanced and expanded in locations including Zanzibar, Pwani, Dar es Salaam, Morogoro, Dodoma, Mwanza, Mbeya, Kilimanjaro and Arusha, with more cities and regions scheduled to be switched on in the coming months.

Related Posts:

- Operator Watch Blog: Tanzania has a Wide Choice of Operators

No comments:

Post a Comment