Zimbabwe’s mobile operators continue to be affected by the country’s poor economy. This has been exacerbated by the significant economic difficulties related to the pandemic. Revenue has also been under pressure from a number of recent regulatory measures and additional taxes imposed by the cash-strapped government. Inflation has become so high that year-on-year revenue comparisons since 2019 have been difficult to assess meaningfully.

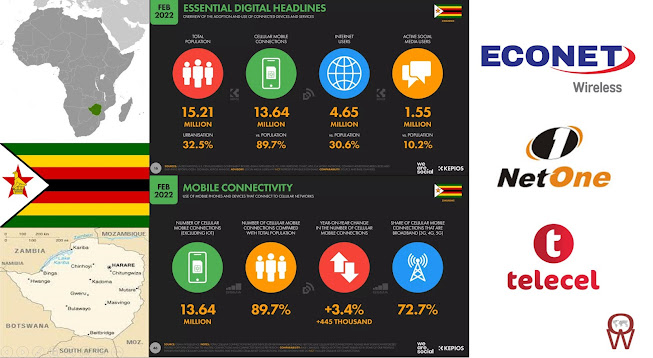

The three MNOs Econet Wireless, NetOne and Telecel Zimbabwe continue to invest in network upgrades, partly supported by government efforts and cash released from the Universal Service Fund. As a result of these investments, LTE networks have expanded steadily, though services remain concentrated in urban areas.

2. Mobile Data Speeds

— Tapuah n (@TapuahN) September 30, 2021

Zimbabwe is placed at 135 / 140 with an average speed of 13.71mbps. In comparison at no 1, is the UAE with download speeds of 195.5mbps. https://t.co/FkiUoTqqfy pic.twitter.com/G14wSfRJto

International bandwidth has improved since fibre links to several submarine cables were established via neighbouring countries. The expansion of 3G and LTE-based mobile broadband services has meant that most of the population has access to the internet. The government has started a national broadband scheme aimed at delivering a 1Mb/s service nationally by 2030. Investment in fixed broadband infrastructure has also resulted in a slow but steady growth in the number of DSL connections, and also fibre subscriptions. During 2021, most growth in the fixed broadband segment has been with fibre connections.

Econet is the market leader in Zimbabwe with over 12.4 million connected customers they have invested millions of US dollars in deploying the widest and most robust 2G, 3G,4G and now 5G networks in the country.

Econet Wireless Zimbabwe has teamed up with Ericsson to launch 5G services in Harare. The Swedish vendor is providing RAN and 5G evolved packet core equipment, while also providing a Network Functions Virtualisation Infrastructure (NFVI) platform to ensure a smooth upgrade from 3G and 4G technologies. Econet plans to deploy 22 5G base stations during 2022.

We're delighted to have scooped the 1st runner up award for The Best Mobile Telecoms in Zimbabwe. Thank you our valued customers for making this success possible.@CCAZ2 pic.twitter.com/SVZqz5HMWF

— NetOne Cellular (@NetOneCellular) October 21, 2022

NetOne is the 2nd provider in Zimbabwe by user numbers, but they started even before Econet. The state-owned company is co-managed with TelOne, the national landline operator.

In 2021 they announced they were looking to deploy more than 260 new base stations under the third phase of its mobile broadband expansion project, with a focus on rural areas. A report from The Herald quotes Deputy ICT Minister Dingumuzi Phuti as saying that NetOne had already upgraded 75 base stations from 2G to 3G and a further 60 to 4G. The government has also revealed that the operator is expecting to install the country’s first 5G equipment as part of its network expansion. The project is expected to increase the operator’s population coverage from about 75% to 85%, though a completion date has not been given. NetOne was also working with Huawei on the USD71 million rollout, which is described as a ‘strategic cooperation between China and Zimbabwe’. According to TeleGeography’s GlobalComms Database, NetOne is the second largest of Zimbabwe’s three mobile network operators (MNOs), with around 3.75 million subscribers and a 29% share of the market at the end of June 2021.

Wayback Wednesday!! Do you still remember?#tellsomeone pic.twitter.com/5bfzRALJY3

— Telecel Zimbabwe (@Telecel_Zim) September 28, 2022

Telecel is the smallest operator in Zimbabwe. It is expected to be placed under corporate rescue, a form of bankruptcy protection, due to ‘serious financial distress’. According to a report from The Herald, David Mhambare, the secretary general of the Communication and Allied Service Workers Union of Zimbabwe, is cited in a high court application as saying: ‘The … conditions indicate the existence of a material uncertainty that may cast significant doubt on the company’s ability to continue operating as a going concern. If the solvency position of Telecel does not receive prime attention, it will inevitably go under liquidation.’ At 31 December 2021 Telecel’s liabilities outweighed its assets by a factor of sixteen to one.

TeleGeography’s GlobalComms Database notes that Telecel, by far the smallest of Zimbabwe’s three mobile service providers, has been struggling financially and facing a declining subscription base for some time.

Related Posts:

- Operator Watch Blog: Zimbabwe: Progress and Development

No comments:

Post a Comment